The Retirement Question

“How did you know it was time to retire?”

I was asked that question twice last week… once by a reader (IK) and once by

the CEO of a Japanese publishing company that is doing some kind of documentary about me and how I built my wealth.

But I am not the right person to ask, because I have tried and failed to retire four times in my life.

First, when I was 39 and had accumulated a net worth of $10 million, which I thought would be enough to pay for my “needs” for the rest of my life.

But I was wrong. The problem was that, as I was increasing my net worth from negative to $10 million, I had bought a much bigger home and had become accustomed to a more costly (but not necessarily more enjoyable) lifestyle, where I needed about $500,000 a year to cover my expenses.

I had a choice. I could sell my house, move into a smaller one in a less expensive neighborhood, and be frugal with my money. Or I could go back to work.

So, I went back to work when I was 40, starting several small side businesses with the goal of producing enough in extra cash flow to support my new lifestyle, and was able to hit that goal by the time I was 49.

Now, I thought, I can retire. But by then I had started three non-profits that were great fun but needed an endowment to fully fund their work.

Realizing that my now net worth was not going to be enough, I went back to work at my old business full-time.

Ten years later, when I was 59, my net worth had grown more than I expected it to. But by then, the cost of my non-profits had tripled (because I couldn’t stop myself from expanding them). And I realized that, once again, I would have to forgo my dream of completely retiring.

I drastically reduced the hours I would normally have to work by hiring CEOs, CFOs, and COOs to take care of the day-to-day management of my side businesses, which left me free to do all the things one is supposed to do in retirement – like play golf, take cruises, and write books.

I did that, and it seemed to be working quite well. Except I discovered that golf was a masochist’s game, and that the books I was writing were about entrepreneurship and wealth building… which got me back into the mood of starting new businesses.

So, by the time I was 69, I had a net worth that was more than what I needed to cover the costs of my three principal non-profits, plus enough for a comfortable retirement. There was no good excuse for me to keep working. And yet, I could not bring myself to give up my regular involvement in several of my businesses – particularly those that were in their early stages of growth. On top of that, I had become fully entrenched in writing my blog.

So here I am at 73, and still working 50- to 70-hour weeks. The only difference is that now a large portion of my daily work is for the non-profits and, thus, essentially unpaid.

The good news is that my boys are gradually taking over the running of my businesses, projects, and charities – at a rate that should allow me to truly retire in 2025. At least, that’s the plan.

So, right about now I’m sure you are thinking, “Thanks for nothing. You never answered the ‘How did you know it was time to retire?’ question.”

And you are right. As I said, I have tried and failed to retire four times in my career. Twice because I needed more income than I had expected to need, and twice because I simply didn’t want to stop working.

So, that’s not “nothing.” There is a whole lot to be learned by thinking about my failed attempts.

The most important thing I can tell you is this: If you don’t like the work you are doing, if you don’t mostly love the work you are doing, you should either retire the moment you have enough money to do it… or you should find a way to edge yourself into a role in your industry that can provide you with so much enjoyment that you won’t want to retire.

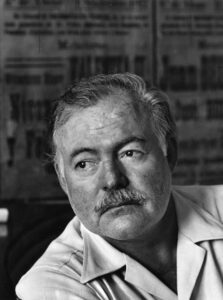

MarkFord

MarkFord